Before Its Potential, Investor Appetite Has Been Wetted Quickly.

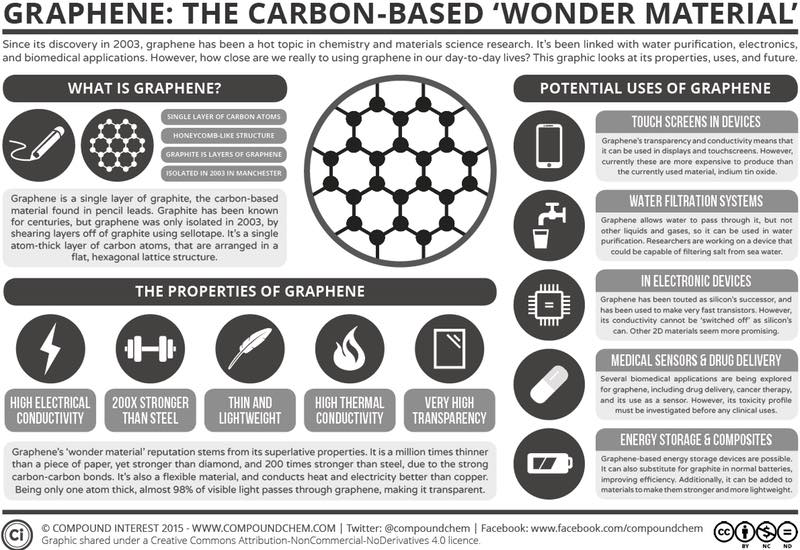

Articles and analyses have proliferated and a true bubble is created on graphene. The reason is simple, as we shall see, the application possibilities are endless. Impossible for me to list all the potential applications of graphene – new are discovered every day. So I will offer an overview of the main sectors in which graphene could overturn the deal.

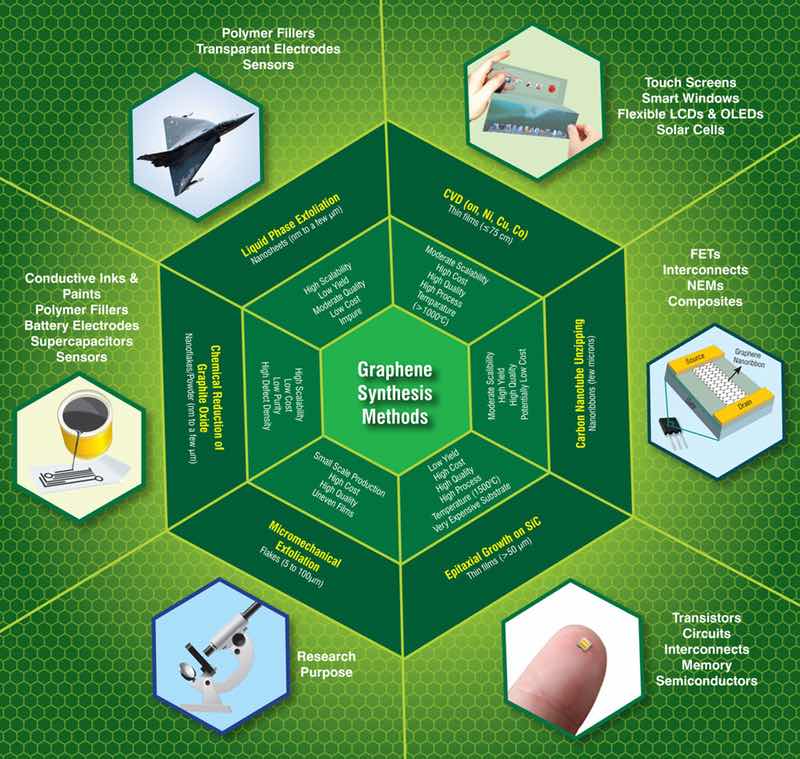

The basic principle of the use of graphene is that of Very thin “sheets” of graphene are interspersed with other materials to enhance properties or create new ones making a graphene investment worth while. First area concerned, of course, the electronics, thanks to its conductive properties. To put it simply, say that graphene could replace silicon, a material used in the manufacture of most electronic circuits. But these circuits, you will find anywhere, from the simplest electronic gadget as the most complex inventions.

Graphene Investments

Graphene Investments

Advantages Of Graphene On Silicon Is Its Superior Conductivity

Electrons move it up to 200 times faster. In addition, it is more stable than silicon, thus ensuring a longer life of all components. Another advantage: it allows the manufacture of extremely small electronic components. Graphene could therefore replace silicon in advanced electronics, with the electronics manufacturing ultrafast several hundred gigahertz frequency.

Eventually, the production of processors (CPU, Central Processing Unit, a chip that makes your computer run) reaching frequencies of 400Ghz+, while most of them today are reaching 5Ghz, another graphene investment potential. This lets you see the possibilities of the calculations and power that can be achieved by these chips integrating graphene. Smaller battery, more powerful Silicon is not alone in having to bow before the potential of graphene.

This Is Also The Case Of Lithium, Especially In Its Use In Batteries.

The lithium-ion batteries are now the most effective batteries. They equip most of your mobile devices, such as smartphones, tablets and other electronic devices. A team from the University of California, Los Angeles (UCLA), led by Professor Richard Kaner, proposed last year an electrochemical capacitor (basically, a battery), including graphene. The result is a battery 100-1000 times more powerful than lithium-ion batterys and especially able to charge up in less time. There is some limitations to the use of lithium-ion batteries.

Their performances decrease rapidly over time, which does not allow them to be used to power large electrical appliances, such as electric cars. One example among others is you could fully charge your smartphone in about 10 minutes. Batteries that are also twice as light as current ones and would greatly reduce the weight of our portable devices. Flexible, transparent screens is another scope of graphene.

Most LCD flat screens, but also the touch screens or LEDs use today indium, or rather on the indium tin oxide (ITO). The ITO has two qualities absolutely essential to the products I have just mentioned: it is both conductive and transparent. But indium is a rare metal. This by-product of the mining of lead and zinc industry, should see its reserves be depleted by 2020.

Graphene Applications

Graphene Applications

The Recycling Could Be A Solution But It Is Still In Its Infancy.

Under the effect of soaring demand and limited supply, the price of indium soared from about $300 per pound in early 2009 and now its currently $740. Graphene, which has both these qualities, could be an excellent substitute. It would provide even more additional qualities, and in particular the flexibility. Graphene then allows the manufacture of flexible displays. More efficient solar panels made with Graphene could also conquer the solar and photovoltaic sector. Research in this area focuses on the integration of a graphene layers amid other materials (such as molybdenum disulfide). Possible graphene investment?

Down the road, creating solar cells, which taken in isolation, have underperformed the currently existing cells but are much smaller. therefore these cells generate power at least 30 times higher than the same volume of the most efficient photovoltaic cells. The material to do everything? Besides these major sectors, the graphene usage possibilities are as varied as its features. Mixed with polymers, it would allow the marketing of new heating paints. Added to the fibers, it would create heating or electronic tissue. It could also replace the carbon in the concentration of composite composition.

Carbon Is Widely Used In The Aviation Industry To Lighten And Strengthen The Aircraft.

Lighter and stronger, graphene could again be an excellent substitute. Finally, the US company Lockheed Martin has developed a graphene filter, the Perforene, improving desalination techniques. The operation is quite simple (on paper at least): salt water is pressurized to make it pass through the graphene filter, which retains salt. The very small thickness of the filter (500 times thinner than the best current filters) significantly reduces the pressure required to the desalination process.

Graphene Patents

Graphene Patents

Less pressure means less energy required and therefore a drastic decline in the cost of desalination. Lockheed Martin plans to test its filter this year or in 2017. As for its marketing, it will be yet From theory to practice, and this is a major problem which confronts the investor interested in graphene: the current lack of commercial uses. As we saw in a previous article, graphene manufacturing process remains complicated and expensive. The manufacture of 1 gram of graphene is still $800, preventing mass use. Looking ahead – both for production and applications – but graphene is most often used for prototypes for marketable products. Can you really mae a graphene investment? The investment on graphene therefore remains very uncertain, if not extremely complicated.

Companies Directly Involved In The Manufacturing

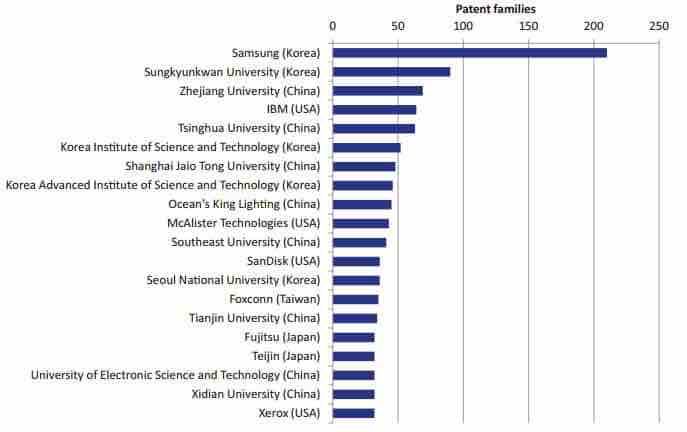

And current practical and commercial applications is such that graphene has become a mined area for investors. however here are some ideas for you to build on its potential: – graphite producers. Graphite is the basis of graphene, essential for its manufacture. One of the simplest and least risky investment on graphene is to focus on the source. Among the producers, the most frequently cited is Graftech International (NYSE: GTI) – Graphene manufacturers themselves. Finally, investors are flocking towards them, pushing them well over beyond the reasonable.

But it is true that if one of them manages to produce industrial quantities of graphene, this will be the jackpot. Be careful though, once production reaches sufficient quantities, the price of graphene will collapse. Among these producers (I repeat: highly speculative investment!), Applied Materials Graphene (LSE: AGM). – Finally, you can bet on large companies heavily involved in research applications for graphene.

Among them, Samsung, BASF, Lockheed Martin … An indirect but certainly much less risky way And for those of you who want to bet on another competitor such as silicon chips, you can look on the side of “PIC” (photonic integrated circuit), a system used in optical data transport platforms . Potential graphene investment? you decide